Why Employers Need to Take Part in Employee Financial Health

Friday, May 26, 2017 · spcontrol

The gig economy, generational differences in the workplace, and changing family structures. These are the issues that workplaces are tackling as they seek to provide their employees with comprehensive and flexible benefits.

According to MetLife’s 15th Annual U.S. Employee Benefit Trends Study, there are some key benefits and resources that employees want from their employers. Employees agree that they want more options when it comes to benefits, and more guidance when it comes to their finances.

The study notes that the percent of employees who believe that employers are responsible for their financial well being has risen in recent years to over 40%. Employees often turn to their employers to help them navigate and find solutions to financial stressors.

Employers should be listening.

When employees feel a greater sense of financial security, they are far more productive and loyal to their employer. Offering programs that help employees feel more financially stable is extremely attractive to potential employees as well.

23% of employees feel that they are less productive at work because of financial worries.

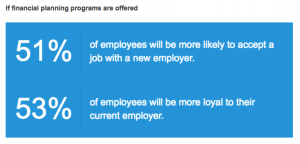

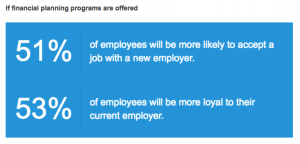

The study found that employees would more likely accept a job and stay loyal to their job if their employer offered financial planning benefits.

[insert picture and link it to the study]

Source: MetLife’s 15th Annual U.S. Employee Benefit Trends Study

What can employers do encourage employee financial health?

Knowledge is a key driver of financial fitness. According to the study, employees who feel knowledgeable about their finances and options available to them are more financially secure. Employers can and should provide resources that educate employees on their financial options.

This is not always easy for startups or small businesses lacking the resources to provide extensive benefits. However, the study notes that it is important for employers to ensure that they offer the benefits that employees want, even if the company doesn’t pay for them. For example, even if an employer does not offer monetary assistance with student debt, they can connect employees to external resources that help pay back or educate employees on student loans.

At SpringFour, we seek to help employers provide knowledge and guidance to their employees, in turn fostering employee loyalty, productivity, and, most importantly, financial health. Our platform helps companies connect their employees to the resources they need to stay current on their mortgage, pay off personal debts faster, obtain affordable health care, or just spend less every month.

Financially healthier employees, empowered with tools and products that build credit, savings, and overall confidence, miss less work and are more productive, a win-win for everyone.

Rochelle Nawrocki Gorey

Co-Founder & CEO